The last three to four years have been rough for the evolving contact centre market – customers, prospects, vendors and investors – but hardships will be overcome by good business practices and innovation. This market is here to stay because companies of all sizes need the technologies contact centre vendors sell to provide outstanding service to their customers.

The last three to four years have been rough for the evolving contact centre market – customers, prospects, vendors and investors – but hardships will be overcome by good business practices and innovation. This market is here to stay because companies of all sizes need the technologies contact centre vendors sell to provide outstanding service to their customers.

The greater contact centre market is continuing to undergo major changes in technology, solutions, vendors, positioning and needs and while the transition has caused major disruptions for customers and prospects (as well as for investors and employees), when the market stabilises in late 2004, the products and vendors will be stronger and better able to meet the needs of users.

Mass Confusion

There is so much confusion in the ACD (automatic call distributor/switch), call centre, contact centre, computer telephony integration (CTI), outdialing, customer relationship management (CRM) suites and IP (internet protocol) Telephony markets. Prospects are bewildered by the similar marketing messages coming from what, in reality, are providers of very different technology, applications and functionality.

End users arent sure whether to invest in a classic Time Domain Multiplexor (TDM-based) circuit switch (that theyve depended on since the mid 1970s when ACDs were first introduced), a new and still maturing IP-based technology or a front office CRM suite (from a vendor such as Siebel, Clientel, SAP or PeopleSoft ) to manage their flow of calls and data transactions.

Adding to the complexity, the majority of the CTI vendors present themselves as software-driven Universal Queuing (UQ) vendors, claiming to provide the same functionality as classic ACD vendors (also known as infrastructure providers or platform providers). Likewise, the outdialing vendors lost sight of why people bought their products and compromised their mission. Their failure to deliver viable products led to a market implosion.

The economic slowdown exacerbated an already unfocused market. The classic telephony providers (ACD, IVR, CTI and outdialing) changed their strategy and messaging between 1999 and 2001 to attract sales dollars flowing to CRM suite providers and to match the high stock valuations of eBusiness vendors. In particular, the confusion and lack of direction were caused by three major market factors:

1. Changing customer needs,

2. High valuations of internet businesses, and

3. Availability of new technologies.

The outcome of this turmoil will ultimately be greater innovation, better products, better strategies and stronger vendors, but getting there will continue to be a very painful process for both vendors and end users. The market disarray is expected to continue into 2004 with the winning products, strategies and vendors emerging in the late 2004/early 2005 time frame.

This creates a unique opportunity for vendors (existing, new and emerging) with strong solutions, business plans and effective sales and marketing skills. It has also created a huge challenge for prospects seeking to invest in new contact centre technology.

Changing Customer Needs

ACD technology matured at a steady rate since its inception in the mid-70s. Until the late 1990s, voice-oriented ACD technology was regarded as the primary infrastructure component of call centres. Any system introduced into a call centre had to be capable of being integrated with the ACD.

The ACD vendors, with their dominant position in call centres, shortsightedly ignored the implications of the CRM movement early on, between 1997 and 2001. They were not prepared when their customers and prospects demanded solutions that addressed converged voice and data and applications that managed all aspects of a customer relationship, not just the movement of calls.

The majority of ACD solutions were (and in some cases still are) hardware-oriented and proprietary. These vendors have not been able to make the changes their customers were demanding without overhauling their products, a multi-year initiative.

By the end of the 1990s call centre managers were demanding products to allow them to deliver on the promise of CRM, to address the convergence of the voice and data worlds and to provide multi-channel support but the ACD vendors didnt have anything new to offer. This forced call centre managers to look beyond their primary switch providers and to begin investing in CRM suites in order to meet corporate CRM and eBusiness goals.

High Valuations of Internet Businesses

At the same time as customer needs were changing in the late 1990s, the internet became hot. Many internet companies lacked revenue and viable business models yet had valuations that were multiples of their old economy brothers, whose valuations were based on sound business practices. During this period, companies in all markets, including the ACD market place, lost sight of their primary purpose of providing goods and services that were needed by their customers, in pursuit of stock valuations.

The ACD vendors didnt want to be left out of this Internet market boom and pursued the eBusiness craze. Fundamentally strong telephony/call centre companies purchased eBusiness vendors with weak business models for ridiculously high prices to drive up the stock price.

Other telephony providers changed their corporate and product strategies to join the eBusiness market and boost their stock valuations. A few companies waited out the Internet craze and while their stock prices didnt skyrocket, they had an easier time recovering once the boom went bust.

Availability of New Technologies

As painful and tumultuous as the Internet craze was for the telephony/call centre market, it did produce a number of new and viable products and services for what are now known as contact centres. According to Gartner, a contact centre is a multi-channel (phone, web, IVR, speech, fax, etc), multi-purpose organisation (handling sales, marketing and customer service) that serves a variety of constituents in a logically consolidated but physically disaggregated setting.

The newer technologies and products include software-oriented switches, IP switches, the UQ (which functions as a funnel integrating transactions from multiple channels and applying business rule workflow, routing, queuing and data collections capabilities), and eService applications, including ERMs (E-Mail Response management systems), chat, collaboration and web-based self-service.

But many of the large and generally proprietary switch manufacturers werent ready for these changes; they werent willing to walk away from their classic switches and millions of dollars in R&D investments from which they hadnt yet realised projected payback. This lack of foresight opened the market to the evolving CTI vendors and new competitors, who were nimbler and not tied to the past.

By mid-2000, an increasing percentage of revenues that would previously have gone to ACD vendors were flowing to CRM suite vendors, who promised to give their new customers automation, tools and best practices to better manage customer relationships and improve profitability, filling the void left by ACD vendors.

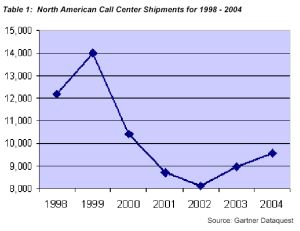

According to Gartner Dataquest, the number of new system shipments in North America decreased by 25.82%, from an all-time high of 14,005 in 1999 to 10,389 in 2000. (The number of new systems shipped decreased another 16.1% in 2001, to 8,717 and are projected to decrease further to 8,096 in 2002.)

According to Gartner Dataquest, the number of new system shipments in North America decreased by 25.82%, from an all-time high of 14,005 in 1999 to 10,389 in 2000. (The number of new systems shipped decreased another 16.1% in 2001, to 8,717 and are projected to decrease further to 8,096 in 2002.)

The ACD vendors were unprepared for this change in customer behaviour; they had been lulled into complacency by continuous increases in customer needs for new ACDs and the demand for replacement switches driven by Y2K.

Year 2000 was a jarring one for most of the switch manufacturers as they saw a significant drop in revenue and finally started facing reality and addressing their product deficiencies. Unfortunately, by then they had lost a great deal of momentum, credibility and revenue.

In all fairness, delivering a universal queue capable of handling transactions from a variety of channels (phone, web, net, fax) required a major shift from hardware oriented solutions to software-based and open systems.

It took 3 to 5 years and a great deal of research and investment for some of the switch manufacturers to begin to deliver this capability. And, it was much easier for many of the large switch manufacturers to deliver a new IP-based UQ than to convert their classic TDM switches (as most of the TDM switches are hardware-oriented and difficult, time-consuming and expensive for vendors to change).

The need to address multiple channels and voice and data convergence has pushed the market towards IP solutions. 2003 will be known as the year when IP ACDs became viable, even if they do not yet scale or have all of the ACD functionality of the classic switches.

IP telephony is being adopted in Northern Europe and in a small number of risk-taking organisations in North America. It will take a few more years and significantly improved IP telephony offerings before the more risk-averse general business population invests in IP switches. Ironically, vendors are now pushing their IP switches, a technology that their customer base is not actively pursuing.

Vendors and prospects alike are struggling to quantify the return on investment (ROI) for the new IP telephony switches. The benefits of IP are real, but limited to Greenfield environments and companies that have multiple switches or sites and can use IP to transfer calls between them.

Also slowing the adoption of IP telephony was the flood of new switches installed prior to Y2K. As many companies keep their switches for 10 to 15 years, those who installed a new switch in the last few years are not likely candidates for a new IP investment.

The Future of Contact Centres

All enterprises that interact with customers (business, government, colleges, etc.) stand to benefit from the infrastructure the platform providers sell. End users prefer to buy from their customary switch vendor who has a proven track record in managing large transaction volumes, unlike CRM suite providers.

But the majority of users are not willing to invest in new and developing products that lack a proven ROI and, even worse, are missing the features and scalability of their dependable workhorses, the TDM -based switches.

The sales outlook isnt all bad, though, even if the market is temporarily confused, challenged and frustrated. By late 2004/early 2005, the contact centre market will again become a growth area, but expect to see changes in players, products and positioning.

The need for contact centre solutions, both large and small, will increase once the economy recovers, particularly as the uses for contact centre capabilities extend beyond traditional areas of customer service, collections, fraud and inbound/outbound sales and as mid-sized companies become larger consumers of these solutions.

Contact centre infrastructure enables logically consolidated but physically disaggregated operating environments. Software-driven switches that more easily integrate with other applications, IP technology, network management software and the UQ will spur the adoption of contact centre technology in businesses where it hasnt been used in the past. Drivers of contact centre growth during the next few years include:

1. Pent up demand;

2. Increasing internationalisation of business;

3. Growing demand from abroad;

4. Conversion of cost centres to profit centres;

5. Improving relationships and cooperation between customer service and marketing organizations, driven by the need to better understand customer behaviour, wants and needs;

6. Importance of capturing and using analytics to better understand customer behaviour and to increase sales and profitability;

7. Demand for remote agents to improve employee satisfaction, reduce agent attrition and to decrease cost;

8. Innovations that allow for the cost effective extension of contact centre technologies throughout enterprises;

9. Availability of ACD solutions that are functionally rich and competitively priced

for small and mid-sized companies or departments (20 to 40 agents);

10. Software-oriented switches that reduce the cost of the technology. As contact centres are increasingly recognized as the focal point for customer interactions throughout the enterprise, their importance will grow within companies.

Its been a tough few years for call and contact centre vendors and prospects, but the challenges have driven innovation and new and improved solutions.

When the pent up demand for ACD infrastructure begins to pick up late in 2004, there will not be a need for just IP ACDs; there will be continued demand for TDM-based switches. IP is a technology with a great deal of potential but its not yet proven enough for risk averse companies and wont be until late in 2005.

Even prospects who dont want to buy an IP switch now or during the next couple of years want to be able to buy one in the future without doing a folk lift and are looking to their contact centre platform provider to have a transition plan and path-to-IP from their classic TDM switches.

The New Contact Centre Platform Vendor

Its no longer enough to provide the call switching, queuing and routing capabilities that were sold by ACD vendors through the late 1990s. While there is a great deal of resistance in the market to general suite providers that cover a variety of functional areas, there is growing interest in vendors that have product depth and provide multiple modules in one functional area.

Prospects are increasingly interested in contact centre or platform providers whose offerings include converged voice and data switching functionality, UQ, IP, CTI, IVR, outdialing, ERM s, web self-service and chat.

Its now also advantageous for providers of contact centre platforms to sell workforce management software, network management software, eService functionality and speech recognition.

Basic call recording or logging software is included with many of the all-in-one contact centre offerings (from vendors such as Interactive Intelligence, eOn, or Appropos, for example), but is not yet included in the offerings of the larger switch manufacturers (Avaya, Nortel, Siemens), the classic contact centre providers (Aspect, Genesys, Rockwell) or Ciscos new IP switch.

Building a World-Class Contact Centre

Even with the growing footprints of the platform providers, enterprises that want to build a world-class contact centre will have to buy products from a number of different sources, as they will not find one vendor who has it all. The components of a leading-edge contact centre include:

· Core Infrastructure – ACD, IP telephony, CTI, IVR, Speech Recognition, Dialer, Routing, Queuing, UQ, ERMs, Web self-service, Chat, Collaboration, Fax and Call Tracking.

· Management Tools – Work Force Optimisation (planning and forecasting), Agent Performance Management, Logging, Quality Management and Customer Experience Management (CEM ), Surveying, E-Learning, Reporting and Analytics.

· Supporting Applications – Knowledge Management, Problem Resolution, Text-Categorisation engine, Real-Time Analytics, Mobile devices, Wireless/ PDA s, Remote agents, Marketing Encyclopedia, Configurator, Letter Generation, Fulfilment, and Scripting

There are a few contact centres that use all of the technology listed above, but the majority use the core infrastructure components and then pick and choose other functionality and systems that are most relevant for them.

As contact centres must justify any investment made in technology, people, or process, its essential to invest in components and processes that have the highest financial payback and benefits for the company.

Just because a single component doesnt pay for itself quickly enough doesnt mean that it shouldnt be included in the contact centre. When a single application or system cannot be justified on a stand-alone basis, incorporate a number of logically related components in one return on investment (ROI) analysis.

Final Thoughts

Upheaval in the contact centre market, changes in strategy, platform, technology, architecture, and functionality accompanied by the financial instability of many of the vendors in this market are the major factors hampering prospects from making long-term investment decisions.

Further complicating the decision to purchase are vendors who are pushing their customers and prospects toward their new IP products, in many cases before the value is clear.

While it will take another two years before the greater contact centre market place and products stabilise, prospects will ultimately have better and stronger providers and products to choose from. In the meantime, users should continue to carefully assess vendors by focusing on financial stability, short and long-term strategies, product road map (look for a path to IP even if its not in your current purchase plans), voice and data convergence, UQ and architecture.

Contact centres are finally beginning to migrate from their closed and proprietary systems to more open architectures that can be accessed by other parts of an enterprise. This is a trend that will be of great benefit to companies as contact centres share critical customer information with decision makers in near real time.

Donna Fluss

donna.fluss@dmgconsult.com

2003-06-18

Em Foco – Opinião

Consultoria – Advice