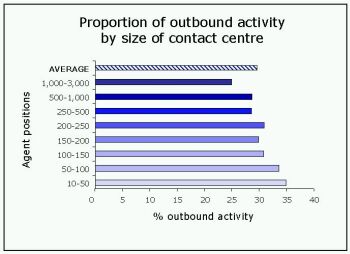

On average terms, UK call and contact centre activity ratio is 70 per cent inbound and 30 per cent outbound. UK contact centres receive a bulk of around 43 billion inbound minutes per year, with the majority being dealt with by 250-agents-and-over contact centres. Finance sector leads on both markets. These and other figures can be found in a study carried out by ContactBabel to around 3,000 UK call and contact centres.

The study shows that there is an inverse relation between the size of contact centre and the proportion of outbound activity: around 35 per cent of the activity of 10-50 agents centres is outbound, whereas in the 1000-3000 agents it only represents 25 per cent. Nevertheless, the absolute figures reveal that agents are mainly concentrated on the two extremes: the 10-50 hold more than 20,800 outbound agent positions, the 200-250 around 6,600, while large contact centres (250 positions and over) more than 65,800.

The fact of small call centres hosting a bigger proportion of outbound activities can be explained, according to ContactBabel, with the continued decrease in call costs. There are a large number of smaller contact centres which perform market research and outsourced telemarketing activities on behalf of other clients. As call costs fall further, and VoIP becomes a more popular option, this deflationary pressure on prices will continue, making outbound calling even more prevalent.

The finance vertical market runs the largest number of outbound activities (around 36,000 positions). Activities comprise debt collection, adverts on new financial products, and cross- and up-selling to existing customers.

Businesses are aware that one of the key moves towards increased profitability is to get customers purchasing multiple products, e.g. a personal loan, a current account, a credit card and insurance from the same provider, the study explains.

Public services and sales & marketing, by opposite reasons, are amongst the vertical markets which do not follow the 70 per cent inbound / 30 per cent outbound pattern . Outbound calling in the public services accounts for only 19 per cent, as many of these operations are non-sales and reactive help-desk environments. On the reverse side, 47 per cent of the sales & marketing contact centres activity is outbound.

With some 35 per cent share (around 15,100 million minutes), finance vertical market ranks first in all inbound traffic as well, followed by retail and distribution (11 per cent) and telecoms (10 per cent). Large call centres (250 agents and more) hold 64 per cent of the inbound bulk, but the 10-50 size band holds almost 12 per cent, ranking fourth (out of eight size bands considered for this study).

Forecasts for the future

ContactBabel foresees a relative decrease of inbound calling to outbound as a result of new media providing more effective ways through which customer can get in touch with businesses.

An increase in outbound market (up to the 35 per cent share) wont be as related with cold calling (contacts to potential new customers) as with warm calling (normally cross- or up-selling to existing customers). Nevertheless, in ContactBabel s opinion, warm calling is often seen by businesses as an easy way to generate revenues without having to perform too much extra-thinking:

Too many companies are trawling all the way through their customer lists, and trying to sell new products and services to customers, regardless of whether the customers will need them: there is not enough analysis of customer preferences and desires first.

There is no real difference between cold calling someone a company has not yet sold to, and calling an existing customer without understanding who that customer is and what they are likely to be interested in: both are unlikely to reap rewards. Businesses should be very wary of running indiscriminate cross-selling and up-selling campaigns to existing customers it could backfire on them, ContactBabel concludes.

Filipe Samora

2003-01-27

Source (data and charts): ContactBabel. All data report to 2002.

ContactBabel is a UK-based analysis firm focusing upon the global contact centre and CRM industries.

Em Foco – Empresa